The Limits of Interdependence: Cooperation and Conflict in Sino-Japanese Relations

Published January, 2014

Pages 51-89

DOI: http://dx.doi.org/10.21159/nv.06.03

New Voices

Volume 6

© The Japan Foundation, Sydney, 2014

Permalinks for references are available in the HTML version of this article.

Abstract

Since the introduction of Deng Xiaoping’s Open Door policy in 1979, the value and complexity of Sino-Japanese economic ties have grown exponentially. However, even as economic ties have developed, security relations have deteriorated as perceptions of a China threat’ and a re-militarised Japan’ have emerged in Tokyo and Beijing. The simultaneous existence of these trends challenges international relations theory. Economic interdependence theories expect that the development of economic relations reduces the role of security in bilateral relations. Conversely, neorealist theories posit that, given the preeminence of national security, a perception of threat will cool economic relations.

Sino-Japanese economic relations have demonstrable bilateral benefits. Additionally, economic relations have created interest groups invested in maintaining good relations. These groups have successfully managed economic friction points and integrated bilateral trade. However, economic interdependence seems not to translate to the security calculus confirming neorealism’s contention that national security is preeminent. In particular, Japan’s development of Ballistic Missile Defence (BMD) illustrates the insignificance of economic ties in security planning. That said, it is equally true that perceptions of threat appear to have little influence on bilateral economic interdependence. Therefore, Sino-Japanese relations are best described by applying interdependence and neorealist theories in a complementary approach.

Interdependence and Neorealism

The competing theories of liberal-interdependence and neorealism conceive of the conditions under which states interact differently. Neorealists state that interaction is a product of the anarchical (i.e., the absence of a sovereign power) system of states.1 They emphasise that, in such a system, states must give their overwhelming priority to achieving security by maintaining a balance of military-strategic power with rival states.2 For neorealists, anarchy also works to constrain state cooperation, as the competitive nature of the international system means that states are most concerned about preventing the relative gains of rivals.3 There are two broad schools of neorealism. The split lies in how these schools understand the way states attempt to achieve security.4 Offensive realists posit that, to achieve security, states seek to maximise their share of world power, with the ultimate goal of regional hegemony.5 In contrast, defensive realists6 contend that states do the minimum necessary to counter perceived threats and maintain a balance of power.7 For defensive realists, threats from other states are assessed according to that state’s geographic proximity, offensive capability and perceived intentions.’8

Complex interdependence theorists do not entirely reject realist principles regarding the importance of the balance of power or state security.9 However, they contend that the international states system has evolved into a world of complex interdependence,’10 or trading states.’11 Interdependence theorists Keohane and Nye posit a system of states where states do not exercise force in their region; there are multiple channels of trans- governmental and/or trans-national contact; and there is no clear hierarchy of issues amongst states, because military security is no longer their dominant consideration.12 Interdependence theorists contend that states are increasingly focused on economic growth and social welfare, which is best obtained through international economic cooperation, and these forces drive states into relationships of mutual dependence.13

Interdependence theories generally contend that conflict is reduced between states engaged in interdependent economic relations.14 One argument contends that as the value of the social welfare benefits gained from state cooperation increases, so too do the costs of conflict (i.e., the loss of those benefits), and consequently this reduces the incidence of conflict.15 This interdependence further reduces conflict by creating a positive feedback loop whereby cooperation encourages further cooperation, resulting in a functional web of interdependence’.16 A second approach contends that economic interdependence creates domestic-level interest groups such as consumers and producers, who benefit from peaceful relations and apply domestic pressure on national governments to prevent the outbreak of conflicts.17

Neorealists critique interdependence in a number of ways. First, neorealists contend that survival is the pre-eminent value of states.18 Therefore, when facing a threat, states must prioritise the security imperative and balance militarily against an identified threat, regardless of the costs and foregone benefits. Neorealists describe a security dilemma’, where self-help efforts by one state to increase its own security, either through building alliances or increasing military strength, create a corresponding reduction in the feeling of security felt by other states. Other states will then respond to their feelings of reduced security by taking similar self-help measures to increase their own security. 19 For neorealists, in a system characterised by self-help and anarchy, economic interdependence can only be a weak influence.

Second, neorealists tend to dismiss interdependence, arguing that the ability to adjust policy in response to external events indicates a lack of sufficient vulnerability to create dependency.20 Waltz argues that economic vulnerability is a rare circumstance that occurs where a state is quantitatively dependent on high percentages of trade and investment or qualitatively dependent on a scarce product or service.21 Neorealists further argue that under anarchy, states seek only relative gains,22 and that interdependence is in fact a cloaked form of dependency where stronger states manipulate their rivals’ vulnerabilities into arrangements that allow them to reap unequal benefits.23 According to this perspective, interdependence actually heightens the risk of conflict because the exploitation of vulnerabilities often leads to conflict. The US oil embargo against Japan in 1941 has been cited as a classic example.24

A third neorealist critique contends that closer contact through economic interdependence increases the points of potential competitive tension between states, thereby amplifying the potential for conflict.25 Neorealists contend that intense competition results in rises and falls in the relative power of states and is therefore a common precursor to war.26 For example, in her study of trade relations, Barbieri found that extensive economic interdependence increased the likelihood that states would engage in conflict.27 For neorealists, increased economic interdependence means increased economic competition, and therefore, an increased chance of conflict.

Sino-Japanese Relations

This paper contends that Sino-Japanese relations can only be fully understood by applying both economic interdependence and neorealist theoretical perspectives. Defensive realism accurately describes the way Tokyo and Beijing seek to militarily balance against threats, while economic interdependence theories illuminate the significant costs that economic cooperation can create and its real effects on economic policy choice. However, neorealism fails to appreciate the complexity of Sino-Japanese economic relations, and in particular, that such bonds are not easily broken. Conversely, economic interdependence theories overestimate the ability of economic cooperation to translate into the military-strategic policy choices of Tokyo and Beijing.

Sino-Japanese Economic Interdependence

Sino-Japanese economic interdependence is characterised by lucrative bilateral trade and investment, with Japan and China obtaining large welfare benefits from their economic relations.28 In addition, significant integrated production operations are present. Simply understood, foreign trade confers benefits on national economies by giving consumers access to better and cheaper goods and increasing the size of markets for producers.29 The economies of both Japan and China are integrated into the world economy. In 2005, Japan’s trade in goods equalled 20% of Gross Domestic Product (GDP), while for China it was 64% of GDP.30 This suggests that Japan and China rely heavily on international trade and the benefits that accrue for their national economies.

Value

One way to demonstrate economic interdependence is to examine the value and growth of bilateral trade. Unless otherwise indicated, the figures and charts in this section have been calculated using International Monetary Fund (IMF) Annual Trade Yearbooks. However, an important statistical limitation of IMF figures should be noted: there is a major difference between the export and import figures reported by Japan and China. This is primarily a result of incorrect identification of imports and exports moving through Hong Kong without paying duties (i.e., entrepà´t trade).31 Chart 1 shows that since the implementation of China’s Open Door policy in 1979,32 the total value of annual Sino-Japanese trade has grown exponentially, from US$6.9 billion to US$302.7 billion in 2010.33 By comparison, Canada-US trade totaled US$493.4 billion in 2010.34 Sino-Japanese trade has grown at a compound average rate of 15% since 1979, and has proven consistent over both the Japanese and Chinese export and import sectors. The annual value of Japanese exports to China has grown from US$3.94 billion in 1979 to US$133.9 billion in 2007, while Chinese exports to Japan have risen from US$2.93 billion to US$127.6 billion. These figures demonstrate the impressive value and consistency of trade interdependence between Japan and China.

Chart 1.

Relative Importance

A second demonstration of Sino-Japanese economic interdependence is the relative importance of Japan and China to each other’s external trade.

From the Japanese perspective:

- China is Japan’s most important partner, with two-way trade comprising 19% of Japanese imports and exports;

- China is Japan’s second-most important export market at 17%; and

- China is Japan’s most important single-country source of imports at 21%.

From the Chinese perspective:

- Japan is one of China’s three most important trading partners at 15%;

- Japan is China’s third-most important export market (excluding Hong Kong) at 14%; and

- Japan is China’s most important single-country import source at 2%.

Trends

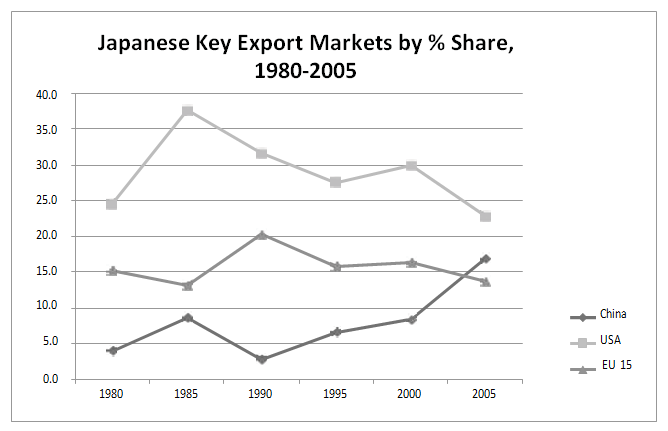

Trade figures may also be used to identify trends in Sino-Japanese bilateral trade. Charts 2, 3 and 4 show that China has become increasingly significant for Japan as an export market, import source and trading partner.

Chart 2.

Chart 3.

Chart 4.

Second, Charts 5, 6 and 7 show that from a high starting point, the relative importance of Japan for China is declining in all these areas.

Chart 5.

Chart 6.

Chart 7.

Trade Intensity

A further measure, trade intensity indices, demonstrates the level of trade bias. Using the method adopted by Hilpert with updated IMF figures,35 this measure assesses the preference of the Chinese and Japanese economies for trade with each other within the context of their respective shares of world trade. An unbiased trading relationship is equivalent to 1. Sino-Japanese relations exhibit significant trade intensity, with a significant bias on both sides. Table 1 shows trade intensity for Japanese exports. In 2005, Japan exported on average 2.6 times more to China than to the rest of the world. Similarly, Table 2 shows that in 2005, China exported 2.8 times more to Japan than to the rest of the world.

Table 1.

Table 2.

Chart 8.

Chart 9.

Chart 8 shows that Japan’s export bias towards China began to increase from 2000 after leveling off between 1995 and 2000. This level ling off has been attributed to political tensions between the two states in this period, stemming in particular from China’s nuclear testing in 1995 and the 1996 Taiwan Straits Crisis.36 Chart 9 shows that China’s export intensity with Japan has declined since 2000. This is generally attributed to the diversification effects on Chinese trade following China’s 2001 entry into the World Trade Organisation (WTO).37

The Value of Japanese FDI in China

This section analyses the effect of Japanese Foreign Direct Investment (FDI) in China on Sino-Japanese economic interdependence. Given the historical absence of Chinese FDI in Japan, this has not been examined here.38 FDI figures compiled by the Organisation of Economic Co-operation and Development (OECD)39 have been used (unless otherwise specified) and Japanese FDI refers to Japanese investment made with the objective of obtaining a lasting interest in an enterprise resident in China.40 Examples of FDI arrangements include wholly-owned subsidiary companies and joint ventures with Chinese partners. However, some limitations should be noted. First, foreign company subsidiaries in Hong Kong are recorded in some statistics as Hong Kong FDI and there are 198 Japanese firms headquartered in Hong Kong;41 second, foreign companies registered in tax havens have distorted figures to the extent that the Virgin Islands were recorded as China’s second largest source of foreign investment in 2006;42 and third, integrated Asian Production Networks (APNs) mean that Japanese FDI to China is often channeled through Taiwan.43

Chart 10 shows Japanese FDI in China. When measured by value, Japanese FDI in China is impressive, with the cumulative total of annual Japanese FDI between 1979 and 2004 equaling approximately US$30 billion.

Chart 10.

In 2006, Japanese firms invested US$9.9 billion in China, which accounted for 5.1% of total Chinese FDI inflows, although this is well down from the relative highs of 16.1% and 14.4% of 1985 and 1990.44 In 2006, Japanese FDI was China’s sixth largest source,45 representing significant welfare benefits to the Chinese economy. For example, in 2004, Japanese FDI represented approximately 20,000 Japanese firms operating in China with a local workforce of around 9.2 million.46

Japanese-led Asian Production Networks

In addition to the welfare benefits outlined above, Japanese FDI made as part of Japanese-led APNs generates further economic interdependence. Japanese multi-national firms have long conceptualised the Asian region as a technologically stratified economy’ and sought to create Japanese-led APNs using a division of labour that would efficiently exploit the factor advantage of each country.47 The country with the highest factor advantage is the country with the lowest unit price for producing an intermediate input in a final product.

A flying geese’ model48 was envisaged, with Japan playing the lead role by providing high-technology, high-value input in research and development, design and precision manufacturing. The newly-industrialised economies of Hong Kong, Singapore, South Korea and Taiwan would provide high-to-medium-technology input, with Indonesia, the Philippines, Malaysia and Thailand responsible for medium-to-low-technology input.49 Since Hatch and Yamamura wrote their seminal study of Japanese-led APNs, the flying geese model has changed in certain respects. Notably, China has increasingly displaced other economies at the bottom of the chain because of its lower cost-base and openness to FDI.50

Japanese FDI in Context

China’s Open Door economic reforms have focused on encouraging Chinese Foreign Invested Enterprises (FIEs) to engage in export production activities which are dependent on advanced foreign technology and industrial organization.51 Chinese policy-makers encourage this arrangement to generate economic activity and create low-skill employment. Additionally, there is an expectation of technology transfer.52 However, one result of China’s reform pattern is an increasing dependence on foreign investment. FIEs dominate the trade sector, accounting for 58% of exports in 2003.53 As a result, the expansion of the export sector and the flow-on benefits such as employment are dependent on increased FDI from Japan (and other industrialised economies). Chinese economic dependency on FIEs, and increasingly, Wholly Owned Foreign Enterprises (WOFEs), is especially pronounced in the industrial and high-technology sectors where these firms account for 88% of exports.54 For example, Charts 11 and 12 show that, as Chinese exports in industrial machinery grew, FIEs also increased their share of production. Similar trends were also experienced in the telecommunication and computer industries.55

Chart 11.

Chart 12.

Japanese FDI in China is generally part of Japanese-led APNs.56 In general, Japanese firms investing in China focus on export-oriented production and channel investment into either labour-intensive assembly operations, or small to medium-sized firms that produce low-to-medium-technology intermediate goods.57 This creates interdependence because Chinese economic activity and employment are dependent on Japanese firms, as the Chinese links in the network cannot operate independently. Japanese firms become dependent, too, as they rely on China’s lower cost-base to maintain international competitiveness. There is also an important geographical dimension. Japanese FDI in China tends to cluster in the Bohai Sea Rim (food and apparel), the Yangtze River Delta (machine tools and electronics), Pearl River/Zhujiang (precision producers and electronics) and the Central West economic zones (still emerging), making these areas especially sensitive to the gains flowing from Japanese FDI.58

In addition to the level of Chinese economic development noted above, Japanese manufacturers’ investment in China also reflects the apprehensions of Japanese policy makers, who fear Japanese industry being hollow[ed] out’ by China’s rise.59 Japanese firms are encouraged to protect their competitive advantages by maintaining precision and high-technology production operations in Japan.60 For example, the Japanese Ministry of Economy, Trade and Industry (METI) encouraged NEC to sell its plasma display business to Japanese-owned Pioneer rather than to a foreign firm.61 Similarly, Canon chose to base its optical sensor factory in Japan.62 As a result, FDI into China has concentrated on final assembly operations and this creates dependency on Japanese- designed production equipment and standards.63

A further benefit for China of Japanese FDI is the technological and industrial development it facilitates.64 However, this has also been a source of tension as Chinese firms and officials tend to criticize Japanese firms for restricting transfers to low-level technology due to a fear of the boomerang effect’.65 Nakagane disputes this claim, arguing that technology transfer occurs in response to economic advantage, and so further Chinese development will attract higher technology investment.66 However, Hatch and Yamamura have persuasively shown that Japanese firms try to use production networks to maintain control over technology,67 and the concentration of Japanese FDI in labour-intensive and low-technology production supports this conclusion.68 That said, although Japanese firms seek to control the speed of technology transfer, benefits do continue to accrue in the Chinese economy, and FDI remains the predominant source of technology transfer.69 For example, NEC and Hitachi have both established advanced production operations in China.70

The empirical evidence shows that significant Sino-Japanese economic cooperation is occurring, as both Japan and China accrue large welfare benefits from the size of their trade relations. Additionally, the integration of Chinese manufacturing into Japanese- led APNs creates further interdependence as Chinese firms lack the technology and productivity to operate independently, and Japanese firms rely on Chinese firms in their wider supply chains.71

Sino-Japanese Economic Competition

It has been shown that Sino-Japanese economic relations are lucrative and provide mutual benefits. However, there are also potential dangers in a relationship of interdependence. Interdependence heightens the frequency and intensity of contact between states, and interdependence theorists warn that friction may emerge from competition over the division of economic benefits.72 For neorealists, increased competition is particularly important as they consider state competition a common precursor to conflict.73 Given this, it is necessary to explore the dimension of competition to fully characterise the nature of Sino-Japanese economic interdependence.

In general, there is little evidence of Sino-Japanese trade friction severe enough to cause political spillover effects and create bilateral conflict. This does not exclude the existence of strong Sino-Japanese competition or discriminatory trade barriers. Rather, there do not appear to be examples of friction comparable with the US-Japan trade wars’, and the EU/US-China textile disputes.74 This is in contrast with the intrusion of Sino-Japanese political disputes into the economic realm; for example, the Chinese suspensions of rare earth exports, and the joint exploration of East China Sea gas fields in response to Japan’s detention of the captain and crew of a Chinese fishing boat that rammed a Japanese coast guard vessel in September 2010 near the Diaoyu/Senkaku Islands.75

This section will examine three factors that have led to the absence of significant Sino-Japanese economic friction.

The Effect of Japanese-led APNs

As described above, Japanese FDI in China is concentrated in manufacturing, as part of Japan’s integrated APNs.76 This off-shoring of Japanese manufacturing and the creation of affiliates in China assists in facilitating the Sino-Japanese intermediate goods trade. Japanese affiliates in China drive procurement of Japanese-sourced parts and equipment, either via pressure from the Japanese-based mother company’,77 or by the in-built dependency of the affiliate on high-value Japanese-based equipment and intermediate products.78 The result is managed trade that creates mutual economic benefits. Japanese firms hold their place at the technological edge and drive productivity, while for China, labour-intensive assembly jobs help create employment and provide technology transfer. However, some bilateral tensions have arisen, stemming from Chinese perceptions that Japanese firms are reluctant to transfer technology,79 as well as protectionist Chinese laws aimed at forcing foreign manufacturers to shift production to China; for example, the imposition of higher duties on imported hybrid vehicles.80

The Effect of the WTO System

Arguably, the most important reason for a lack of friction is China’s accession to the WTO and its subsequent general acceptance of the WTO system. There are two key consequences for Sino-Japanese relations: first, market access and economic liberalisation made in preparation for WTO entry and mandated in the post-accession period are opening Chinese domestic markets to Japanese competition;81 and second, the WTO rules and processes have imposed a mutually acceptable conflict resolution framework, which helps to check the spread of these problems into the political realm.82

China’s WTO compliance is still problematic in a number of areas.83 However, given the complexity of its implementation agenda, the international community and most scholars generally accept that China is fulfilling its WTO reform obligations.84

This includes a willingness to comply with international trade law when both formally and informally challenged.85 Japanese firms seeking to compete in the Chinese market have benefited from the improved market access created by the WTO reforms, but barriers and problems remain.86 The Ministry of Economy, Trade and Industry (METI) is particularly concerned with intellectual property (IP) issues, including counterfeiting and piracy, and also Chinese certification of vehicle imports.87 Other more minor trade issues have emerged over Chinese use of WTO safeguard measures on steel imports88 and China’s failure to liberalise the telecommunications market.89

Generally, trade friction has been managed through the WTO, and bilaterally through the Japan-China Economic Partnership Consultation (JCEPC) process. Although Japan has not initiated WTO action against China on any issue, Tokyo has been an interested third party or has participated in consultations on a number of actions where China was the respondent to claims made by other economies.90 While the use of WTO and JCEPC mechanisms indicate that some Sino-Japanese trade friction exists, the management of issues including IP91 and the importation of integrated circuits92 and automobile parts93 through these mechanisms has prevented further escalation. Consequently, the available evidence suggests that market access and competition issues have yet to generate major conflict in bilateral relations that is comparable to the bitter US-Japan trade wars.94 That said, it is worth keeping an eye on issues such as IP protection. Japan has raised IP in a number of international fora and joined, as a third party, the US WTO case against China for its failure to adequately protect IP.95

The Effect of the Nature of Chinese FDI

Finally, it is worth noting that the lack of bilateral economic friction may also be partly explained by the absence of Chinese firms attempting visible takeovers of Japanese firms or aggressively competing in the Japanese market. In terms of FDI, Chinese outflows to the world are still fairly embryonic96 at US$22.5 billion in 2007, with total accumulated FDI stock at US$95.8 billion.97 Chinese FDI is also generally concentrated in assembly and natural resources projects, making Japan a relatively unattractive destination.98 Furthermore, in relation to takeovers, anecdotal evidence suggests (the Japanese government keeps no official figures) that Chinese FDI takes a soft approach by avoiding takeovers. For example, China’s Haier and Guangdong Galanz Enterprise have both entered into the Japanese market using joint ventures with Japanese firms.99 Haier partnered with Japan’s Sanyo, allowing it to utilize Sanyo’s distribution network to sell Haier-branded products in Japan, in return for providing Sanyo with access to its Chinese distribution network.100 Consequently, there have so far been no takeover controversies comparable with Chinese CNOOC’s withdrawn bid for US company Unocal.101 Additionally, where Chinese firms have entered the Japanese market, they have also aimed at the less sophisticated and less lucrative ends of the market.102 For example, Haier targeted the budget end of the Japanese whitegoods market.

Finally, it should be noted that while Chinese-branded goods may pose a threat to some Japanese manufacturers of final consumer goods, other Japanese firms may in fact benefit. In particular, Japanese firms that produce sophisticated components may benefit from increased demand from Chinese manufacturers for their components.103 For example, Nidec, which has a market share of approximately 70% in hard-disk drive spindle motors, has benefited from rising Chinese demand.104

Sino-Japanese Economic Competition Case Studies

The following case studies of Sino-Japanese economic competition illustrate how Sino-Japanese trade friction is managed.

Case Study 1: Electrical Machinery

The electrical machinery industry has been a long-standing strength of Japanese manufacturers. Given that electrical machinery accounts for 20% of the value of Chinese exports to Japan, there appears to be, prima facie, a challenge to Japanese manufacturers in their home market.105 However, an examination of the characteristics of Chinese exports and Japanese FDI activities reveal that rising electrical machinery imports do not evidence rising Chinese competition, but rather, the success of Japanese firms in restructuring their manufacturing operations and shifting labour-intensive operations offshore to China.

When examining the structure of Chinese exports, it is important to recall that FIEs are responsible for 88% of Chinese high-technology exports, and Chinese production is overwhelmingly concentrated in labour-intensive and medium-skilled activities, such as assembly. This means that Chinese exports of complex manufactures like electrical machinery have generally only been assembled in China and are generally produced as part of foreign-controlled production networks.106

In the late 1990s, Japanese firms in the electrical machinery sector, motivated by the need to lower costs in their labour-intensive operations, began concentrating FDI in China to establish low-cost manufacturing and assembly operations.107 The rise in Chinese electrical machinery imports is the result of this process. The Japanese Ministry of Finance has recognised this, noting that highly sophisticated parts and materials are mostly imported from Japan,’ and that China is the sole location for assembly.’108 Japanese firms assemble their electrical machinery products in China to lower costs, and then re-import the finished products back into Japan or export them from China to other world markets.109 Consequently, the apparent absence of Japanese firms seeking protection from Chinese-import competition can be explained by an industry understanding that these imports largely stem from their own production operations, not competition from Chinese firms. In fact, Japanese firms engaged in off-shoring manufacturing operations in China have an incentive to ensure a liberal trade regime, as they are dependent upon low-cost Chinese operations for their own productivity.

Case Study 2: Textiles

Clothing and textile imports have been an especially fractious issue in EU-China trade relations. As part of the terms of its 2001 WTO accession, China accepted the Multi-Fibre Arrangement (MFA), which restricted textile exports from developing countries to developed countries. The MFA governed the world trade in textiles and garments from 1974 through 2004, imposing quotas on the amount developing countries could export to developed countries. The MFA expired on 1 January 2005 with the transition to WTO arrangements. However, following its expiration, Chinese exports flooded into the EU (and the US). This created a trade dispute, as 75 million Chinese garments were held in European ports and the matter was settled only after high-level negotiations.110 Yet, in contrast, Sino-Japanese trade friction over textiles has not emerged to any comparable degree.111 This is despite rising import penetration of the Japanese textile market from below 20% in 1980 to 40% in 1990 and 85% in 2005, the vast majority sourced from China.112

The absence of Sino-Japanese friction supports the finding in the first case study above: that the complementary nature of Sino-Japanese economic strengths and integration of Chinese firms into Japanese-led APNs has tended to mitigate tensions. Since the 1960s, the Japanese textile industry has been in decline and has experienced continual restructuring, with Japanese firms shifting labour-intensive operations to South-East Asia, and from the 1980s, to China. Additionally, while the volume of Chinese textile exports to Japan continues to rise, they represent only 60% of the value-add.113 This suggests that Japanese firms have retained a position in the capital-and technology-intensive stages of production.114 Furthermore, as with electrical machinery, the recent surge in Chinese textile imports was preceded by significant Japanese FDI in the Chinese textile industry, indicating that Japanese firms are promoting and controlling significant parts of the Chinese export sector.115

The integration of Sino-Japanese textile production has proved critical in mitigating potential friction. Yoshimatsu examined the failed attempt by some Japanese textile manufacturers to obtain WTO safeguard measures against Chinese imports.116 He found that Japanese firms that have integrated offshore production from China into their operations are dependent upon importing finished products into Japan. In Japan, industrial associations play an integral role in coordinating industry matters, such as protection, with the government.117 Although members of the textile industry body began to lobby for protection, METI resisted industry pressure to restrict imports, determining that the industry body was actually divided on the merits of protection. In particular, a number of powerful Japanese trading companies with established Chinese operations did not support the industry body’s efforts because they were dependent upon a liberalised trading regime.118 This incident provides a clear example of interest group interdependence acting to reduce the potential for Sino-Japanese trade conflict by undermining potential protectionism.119

Sino-Japanese economic relations do not exhibit conflict-creating competition. Japanese-led APNs which deeply integrate firms from both countries effectively manage bilateral trade and help to ensure that cooperative gains are distributed in a mutually acceptable manner. APNs have also created domestic interest groups who promote the interests of liberalised trade. In addition, the WTO system has established a mutually acceptable framework for the resolution of disputes and prevented any spill-over into the political realm. Finally, Chinese firms have yet to mount visible competition in areas of Japanese economic strength.

The Sino-Japanese Balance of Power

Neorealist theories predict that Japan and China’s relative power will dictate their behaviour, with power defined in military-strategic terms.120 This paper argues that defensive realism best describes Sino-Japanese security relations, as Tokyo and Beijing seek to maximise their individual security by balancing against perceived threats.121 In particular, economic interdependence appears absent from their security decision-making.

The Sino-Japanese balance of power is complicated by the presence of US military power. The role of the US remains indispensable to understanding the Sino-Japanese security balance. The alliance with Washington continues to underpin Tokyo’s post- Cold War security.122 However, the respective interests of Washington and Tokyo do not always converge, so analysts often conceptualise North-East Asian security in terms of the Beijing-Tokyo-Washington strategic triangle.123 While US military power acts as the ultimate guarantee of Japanese security, the alliance raises a constant dilemma for Tokyo. Japan must both hedge against the risks of US abandonment while avoiding unwanted conflict with China.124

Following the end of the Cold War, Washington set out its blueprint for future security engagement in the Asia-Pacific in the form of the United States Security Strategy for the East Asian Region, commonly known as the Nye Initiative.125 The Nye Initiative confirmed Washington’s commitment to security in the Asia-Pacific region and to maintaining its military presence. Crucially, the Nye Initiative foreshadowed an expanded role for Tokyo in these efforts. In its wake, Beijing began to doubt that the US-Japan alliance still played its traditional role in capping Japanese military ambition.126 Furthermore, following the 1996 Taiwan Straits crisis127 Beijing became acutely aware of the imbalance in military power between Chinese and US-Japanese forces and the implications for a final resolution of the Taiwan issue. Thus, despite the clear benefits for Beijing in the relatively stable East Asian strategic environment that US power guarantees,128 Beijing continued its program of military modernisation.129

However, analysts are divided over Beijing’s strategic intentions. Defensive realists like Kissinger and Brzezinski consider that Beijing may accumulate greater power in an attempt to balance against the perceived US threat, but that it will not seek to overturn the current East Asian order. 130 In particular, they believe that the benefits reaped by China from the current regional order and the difficulty in confronting the US make conflict unlikely.131 In contrast, offensive realists are more pessimistic. They contend that states seek security by maximising their power, and predict a Chinese attempt to overturn the current US-led security environment and establish regional hegemony. 132 The result will be confrontation with the US (and Japan).

The growing Sino-Japanese security dilemma is evidenced by a series of developments since the 1990s that illustrate Tokyo and Beijing’s perceptions of threat and their engagement in balancing behaviour. Particularly notable are:

- clashes over the Senkaku/Diaoyu Islands;133

- friction over the delimitation of the East China Sea maritime boundary;134

- friction over Taiwan;135

- Chinese nuclear testing and modernisation;136

- Chinese conventional force modernisation;137

- Japanese force modernisation and force posture changes;138

- Japanese legislative and institutional reforms, particularly the relaxing of restrictions on the deployment of the Japanese Self-Defense Force; 139

- Japanese external balancing through a tightening of the US-Japan alliance;140

- Japanese participation in the development of Ballistic Missile Defense (BMD) in partnership with the US.

It is beyond the scope of this paper to provide an in-depth analysis of all these issues. However, Japan’s development of BMD provides an excellent case study for analysing the Sino-Japanese security dilemma and illustrating some important aspects of the above issues.

Ballistic Missile Defence

Japanese development of BMD impacts upon Tokyo’s alliance dilemma, as the operational and technical aspects of BMD require an integrated US-Japan partnership, creating a complex web of military interdependence. The stationing of key platforms in Japan, joint US-Japan command and control systems’, and Japan’s technological dependence on US early-warning systems all work to tie Tokyo to US policy choices.141 This reduces the risk of US abandonment, while increasing the risk of entrapment through the compulsive logic of BMD technology.’142 For example, in the event of a Sino-US conflict, such as over Taiwan, the use by the US of BMD platforms, related facilities and sensors stationed in Japan would make it extremely difficult for Japan to stand apart from the conflict.143

The Nye Initiative foreshadowed greater Japanese participation in BMD.144 However, US-Japan development of Theatre Missile Defence (TMD) emerged after the 1996 Hashimoto-Clinton Declaration,145 as Tokyo and Washington sought to reinvigorate the alliance.146 Tokyo’s reluctance to commit to BMD earlier was based on the implications of its security dilemma with Beijing, particularly the risk of entrapment created by tightening the alliance with Washington.147 Tokyo’s decision to participate in BMD was prompted by its concerns over Chinese and North Korean missile threats. The North Korean threat is a substantial element of Japan’s strategic calculus, particularly following the firing of a missile over Honshu in 1998, but is also a useful piece of domestic justification for BMD participation.148 That said, it is the Chinese missile threat which is critical to Japan’s long-term thinking.149

Tokyo’s pursuit of BMD was not an immediate response to China (or North Korea) possessing missile capability, as Beijing has a long-standing missile program; rather, it emerged as Tokyo began to harbour doubts about Beijing’s strategic intentions. Tokyo’s appreciation of a missile threat was prompted by China’s 1995 nuclear testing, Beijing’s opaque military modernisation program, and the 1996 Taiwan Strait Crisis. These incidents combined to exacerbate Tokyo’s doubts about Beijing’s intentions and its ability to exercise influence over Beijing through a long-standing strategy of commercial liberalism.150 Consequently, Japan’s previous caution regarding BMD largely evaporated as it sought to balance against a China threat.

Tokyo has balanced against the missile threat posed by Beijing (and Pyongyang), both through the development of its indigenous BMD capabilities151 and through BMD cooperation with Washington. Ultimately, Tokyo appears to have determined that the risks of entrapment in the US-alliance and a possible Sino-Japanese arms race152 were outweighed by the need to balance against strongly-held suspicions of a Chinese missile threat.153 This suggests that Tokyo is following the logic of defensive realism by balancing against a threat.154

Beijing’s sensitivity to a US-Japanese BMD partnership is based upon three implications for Chinese security. First, BMD heightens Beijing’s fears of a remilitarised Japan.

Second, it threatens to undermine Beijing’s conventional-missile and nuclear-mi

- Keohane and Nye, Power and Interdependence, p. 20. ↩

- Waltz, The Origins of War in Neorealist Theory’, p. 40; Mearsheimer, The Tragedy of Great Power Politics. ↩

- Waltz, The Emerging Structure of International Politics’, p. 66; Grieco, Anarchy and the Limits of Cooperation’; Zhao, Managing the Challenge’. ↩

- Snyder, Myths of Empire, pp. 11-12. ↩

- Mearsheimer, op. cit., p. 410. ↩

- Waltz, Theory of International Politics. ↩

- Walt, The Origins of Alliances. ↩

- ibid., p. 5. ↩

- Keohane and Nye, op. cit., p. 7. ↩

- ibid., p. 26 ↩

- Rosecrance, The Rise of the Trading State, p. 24. ↩

- Keohane and Nye, op. cit., p. 27; Falk, The End of World Order; Grieco, op. cit. ↩

- Keohane and Nye, op. cit.; Rosecrance, op. cit. ↩

- Keohane and Nye, op. cit.; Friedman, The Lexus and the Olive Tree; Polachek, Conflict and Trade’. ↩

- Polachek, op. cit., pp. 60-62; Rosecrance, op. cit. ↩

- Nye, Peace in Parts’, pp. 109-110. ↩

- Arad and Hirsch, Peacemaking and Vested Interests’; Friedman, The World is Flat; Papayoanou, Economic Interdependence and the Balance of Power’. ↩

- Waltz, Structural Realism after the Cold War’. ↩

- Jervis, Cooperation under the Security Dilemma’. ↩

- Waltz, Theory of International Politics, pp. 143-144. ↩

- ibid. ↩

- Grieco, op. cit.; Waltz, Structural Realism after the Cold War’. ↩

- Waltz, The Myth of National Interdependence’, pp. 205-220; Keohane and Waltz, The Neorealist and his Critic’, pp. 204-205; Keohane and Nye, op. cit., pp. 14-17. ↩

- Keohane and Nye, op. cit., p. 14. ↩

- Grieco, op. cit. ↩

- Waltz, Man, the State and War; Waltz, Structural Realism after the Cold War’, p. 33. ↩

- Barbieri, Economic Interdependence’. ↩

- For the purposes of this paper, China’ refers to the People’s Republic of China and excludes Taiwan and the special mandate territories of Hong Kong and Macau unless otherwise specified. ↩

- Polachek, op. cit.; Ricardo, The Principles of Political Economy and Taxation. ↩

- Naughton, The Chinese Economy, p. 376. Note: a glossary of acronyms is provided at the end of this article. ↩

- Hilpert and Nakagane, Economic Relations’. ↩

- Lardy, The Role of Foreign Trade and Investment in China’s Economic Transformation’; Naughton, op. cit.; Goodman, Deng Xiaoping and the Chinese Revolution, p. 92; Zhang, China’s Relations with Japan in an Era of Economic Liberalisation, p. 72. ↩

- WTO, Country Profile: Japan’. ↩

- WTO, Country Profile: Canada’. ↩

- Hilpert and Nakagane, Economic Relations’; also see Anderson and Norheim, History, Geography and Regional Economic Integration’, pp. 23-24, 47-48. ↩

- Sudo, It Takes Two to Tango’, p. 45. ↩

- Rumbaugh and Blancher, China: International Trade and WTO Accession’, p. 3 ↩

- Zhaoxi, China’s Outward Direct Foreign Investment’. ↩

- OECD, OECD International Direct Investment Statistics. ↩

- OECD, OECD Glossary of Statistical Terms ↩

- Naughton, op. cit., p. 415. ↩

- ibid., p. 414. ↩

- Deans, The Taiwan Question’, p. 91. ↩

- Nakagane, Japanese Direct Investment in China’. ↩

- National Bureau of Statistics of China, China Statistical Yearbook 2007 ↩

- Cheng, Sino-Japanese Economic Relations’. ↩

- Katzenstein and Shiraishi, Network Power; Hatch and Yamamura, Asia in Japan’s Embrace. ↩

- Kojima, The Flying Geese Model of Asian Economic Development’. ↩

- Hatch and Yamamura, op. cit., p. 23. ↩

- Albaladejo and Lall, China’s Competitive Performance’; Hatch, Japanese Production Networks in Asia’. ↩

- Gilboy, The Myth Behind China’s Miracle’, pp. 33-48; Naughton, op. cit., pp. 419-423. ↩

- Gilboy, op. cit., pp. 33-48; Naughton, op. cit., pp. 419-423. ↩

- Gilboy, op. cit., p. 38. ↩

- ibid., pp. 33-48; Naughton, op. cit. ↩

- Gilboy, op. cit. ↩

- (Still) Made in Japan’; Questioning the Middle Kingdom’; Samuels, Securing Japan, pp. 159-161; Hatch and Yamamura, op. cit. ↩

- Taube, Japan’s Role in China’s Industrialization’, p. 115; Nakagane, op. cit., pp. 143, 145. ↩

- Farrell, Japanese Foreign Investment in the World Economy, p. 75. ↩

- Samuels, op. cit., p. 160. ↩

- Vogel, Japan Remodelled. ↩

- (Still) Made in Japan’. ↩

- Questioning the Middle Kingdom’; Samuels, op. cit., p. 160. ↩

- Samuels, op. cit., p. 160. ↩

- Lardy, op. cit., pp. 1065-1082. ↩

- Nakagane, op. cit. ↩

- ibid. ↩

- Hatch and Yamamura, op. cit. ↩

- Samuels, op. cit., pp. 159-167; (Still) Made in Japan’; Questioning the Middle Kingdom’. ↩

- Nakagane, op. cit.; Naughton, op. cit., pp. 306, 406. ↩

- Nakagane, op. cit., p. 69; Hatch and Yamamura, op. cit.; Samuels, op. cit., pp. 159-161. ↩

- Hilpert and Nakagane, op. cit., p. 146. ↩

- Keohane and Nye, op. cit., p. 9. ↩

- Waltz, The Origins of War in Neorealist Theory’, pp. 43-44; Waltz, Structural Realism after the Cold War’, p. 14; Barbieri, op. cit., pp. 29-49. ↩

- Spencer, Japan as Competitor’; Bhagwati, The US-Japan Car Dispute’. ↩

- Asia: Bare Anger’; Asia: Deng’s Heirs Ignore his Advice’. ↩

- Farrell, op. cit., p. 75. ↩

- Hu, Japanese Firms in China’, p. 165. ↩

- Hatch and Yamamura, op. cit.; Samuels, op. cit., pp. 159-161. ↩

- Tang, Sino-Japanese Technology Transfer and its Effects’, pp. 152-168; Nakagane, op. cit.; Taube, op. cit. ↩

- METI, Report on Compliance by Major Trading Partners with Trade Agreements’, p. 45; Going Green at the Shanghai Show’. ↩

- WTO, Protocol on the Accession of the People’s Republic of China 2001; US Congress China Security Review Commission, Annual Report to Congress 2002; Naughton, op. cit.; Lardy, Integrating China into the Global Economy’. ↩

- Keohane and Martin, The Promise of Institutional Theory’. ↩

- US-China Economic and Security Review Commission, Annual Report to Congress 2008′, pp. 25, 36-37; METI, op. cit. ↩

- Lawrence, China and the Multilateral Trading System’; Naughton, op. cit.; METI, op. cit. ↩

- Lawrence, op. cit., p. 148. ↩

- METI, cit.; JBIC, 2008 Survey Report on Overseas Business Operations by Japanese Manufacturing Companies’, p. 16. ↩

- METI, METI Priorities on WTO Inconsistent Foreign Trade Policies, p. 1; METI, Report on Compliance by Major Trading Partners with Trade Agreements‘. ↩

- China to Invoke WTO Safeguards on Steel Imports’. ↩

- METI, Report on Compliance by Major Trading Partners with Trade Agreements, pp. 66-68; Marukawa, Why Japanese Multinationals Failed in the Chinese Mobile Phone Market’, p. 417. ↩

- WTO Dispute, China—Measures Affecting the Protection and Enforcement of Intellectual Property Rights; WTO Dispute, China—Value-Added Tax on Integrated Circuits; WTO Dispute, China—Measures Affecting Imports of Automobile Parts. ↩

- Ibid ↩

- WTO Dispute, China—Value-Added Tax on Integrated Circuits. ↩

- WTO Dispute, China—Measures Affecting Imports of Automobile Parts. ↩

- Schoppa, Bargaining with Japan. ↩

- METI, Report on Compliance by Major Trading Partners with Trade Agreements; WTO Dispute, China—Measures Affecting the Protection and Enforcement of Intellectual Property Rights. ↩

- Zhaoxi, op. cit., pp. 49-77, 68-9. ↩

- UNCTAD, Country Fact Sheet China World Investment Report 2008. ↩

- ibid., p. 60. ↩

- Nakamura, Asian Appliance Firms Seek Cracks in Japanese Market’. ↩

- Hu and Wang, International Marketing Strategies of Chinese Multinationals’, pp. 115-6; Haier Targets Japanese Washer-Dryer Market’; The Liquidation of Sanyo Haier’. ↩

- Davidson, Chinese Oil Company Pulls Unocal Bid’. ↩

- Nakamura, op. cit. ↩

- (Still) Made in Japan’, op. cit. ↩

- Tanikawa, Razor Focus With a Heart’. ↩

- Fung et, Japanese Direct Investment in China and Other Countries’, p. 12; Ministry of Finance, Exports and Imports by Commodity’, pp. 88-91. ↩

- Naughton, op. cit., p. 396. ↩

- JETRO, White Paper on Foreign Direct Investment 2002 Growth in Global Investment Slows (Summary), p. 20; Fung et al., op. cit., pp. 44-46. ↩

- Iwatsubo and Karikomi, China’s Reform on Exchange Rate System’, pp. 8-9. ↩

- Okuyama, Japan—East Asia Trade in Electrical Machinery and Equipment’. ↩

- EU Warns China on Textile Exports’; EU and China Reach Textile Deal’. ↩

- Yoshimatsu, Social Demand, State Capability and Globalization: Japan-China’, p. 393. ↩

- Farrell, op. cit., p. 185. ↩

- ibid., p. 185. ↩

- ibid., pp. 175-6, 185-187. ↩

- JETRO, op. cit., p. 20; Yoshimatsu, op. cit., p. 384. ↩

- Yoshimatsu, op. cit., pp. 381-408. ↩

- Dore, Stock Market Capitalism, Welfare Capitalism. ↩

- Yoshimatsu, op. cit., p. 393. ↩

- Papayoanou, op. cit. ↩

- Mearsheimer, op. cit., p. 18; Waltz, Structural Realism after the Cold War’; Walt, op. cit. ↩

- Walt, op. cit. ↩

- Ministry of Defense, Japan Defense White Paper 2008. ↩

- Drifte, Engagement Japanese Style’; Pyle, Japan Rising; Curtis, Getting the Triangle Straight. ↩

- Samuels, op. cit. ↩

- US Department of Defense, United States Security Strategy for the East Asian Region. ↩

- Mann, About Face, p. 44; Kissinger, The White House Years, p. 334; Kissinger, Years of Upheaval, p. 693 ↩

- Mann, op. cit.; Copper, Playing with Fire. ↩

- Yahuda, Looking Ahead’, 347. ↩

- US Department of Defense, Military Power of the People’s Republic of China 2009 Annual Report. ↩

- Brzezinski and Mearsheimer, Clash of the Titans’; Zhao, op. cit. ↩

- ibid. ↩

- Brzezinski and Mearsheimer, op. cit. ↩

- Drifte, Territorial Conflicts in the East China Sea’; Hsiung, Sea Power, Law of the Sea, and a Resource War’; Yu and Kao, The Taiwan Factor in Tokyo’s Territorial Disputes with Beijing’. ↩

- Drifte, Territorial Conflicts in the East China Sea’; Hsiung, op. cit. ↩

- Deans, cit.; Nakai, US-Japan Relations in Asia’; Yu and Kao, op. cit.; Feigenbaum, China’s Challenge to Pax Americana’; US Department of Defense, Military Power of the People’s Republic of China 2009 Annual Report, pp. 20, 41-45. ↩

- Johnston, China’s New ”Old Thinking”’; Shulong and Yu, China: Dynamic Minimum Deterrence’; Johnston, Is China a Status Quo Power?’; Green and Furukawa, Japan: New Nuclear Realism’. ↩

- US Department of Defense, The Military Power of the People’s Republic of China 2009; O’Rourke, China Naval Modernization; Johnston, Is China a Status Quo Power?’. ↩

- Ministry of Defense, National Program Defense Guidelines FY 2005; Samuels, op. cit.; Hickey and Lu, Japan’s Military Modernization’. ↩

- Samuels, op. cit.; Shinoda, Koizumi Diplomacy. ↩

- Green, US-Japan Relations after Koizumi’. ↩

- ibid., p. 78. ↩

- Hughes, Sino-Japanese Relations and BMD’, p. 79. ↩

- Drifte, Engagement Japanese Style’, p. 66. ↩

- US Department of Defense, United States Security Strategy for the East Asian Region February 1995. ↩

- Ministry of Defense, Japan-US Joint Declaration on Security Alliance for the 21st Century’. ↩

- Drifte, Engagement Japanese Style’, p. 57; Nye, The ”Nye Report” 6 Years Later’, p. 99. ↩

- Matthews, Japan’s Missile Defence Dilemma’, p. 130; Hughes, op. cit.; Drifte, Engagement Japanese Style’, p. 64; Soeya, In Defense of No Defense’, p. 23. ↩

- Ministry of Defense, Japan Defense White Paper 2008,’ p. 167; Hughes, op. cit., p. 70. ↩

- Matthews, op. cit., p. 127; Green, Japan’s Reluctant Realism, p. 93; Hughes, op. cit., p. 70; Ching, TMD: Safety Net or Threat’, p. 35. ↩

- Green and Self, Japan’s Changing China Policy’; Green, Japan’s Reluctant Realism; Matthews, op. cit., p. 127. ↩

- Ministry of Defense, Japan’s BMD. ↩

- Matthews, op. cit., pp. 127-8, 130; Drifte, Engagement Japanese Style’, p. 66 ↩

- Heginbotham and Samuels, Japan’s Dual Hedge’; Soeya, op. cit., p. 23; Hughes, op. cit., p. 79. ↩

- Walt, op. cit., p. 5. ↩